Oct 28, 2021 | Press Release

“We Are Seeing a Strong Interest in GHU Technology with Oil Prices on The Rise” RIYADH, SAUDI ARABIA / ACCESSWIRE / October 27, 2021 / Genoil Inc (OTC:GNOLF) signed an agreement to develop a greenfield Genoil Upgrader with a capacity of 600,000 barrels per...

Jun 30, 2021 | Press Release

FUNDING, LICENSES AND ALL PERMITS AS WELL AS FEEDSTOCK SUPPLY AND OFFTAKE AGREEMENTS HAVE BEEN GRANTED TO IMMEDIATELY BEGIN THE PROJECT. MUSCAT, OMAN / ACCESSWIRE / June 30, 2021 / Genoil Inc. (OTC PINK:GNOLF) signed an agreement with the Ras Madrakah Petroleum...

Jul 5, 2019 | GenOil Articles, Press Release

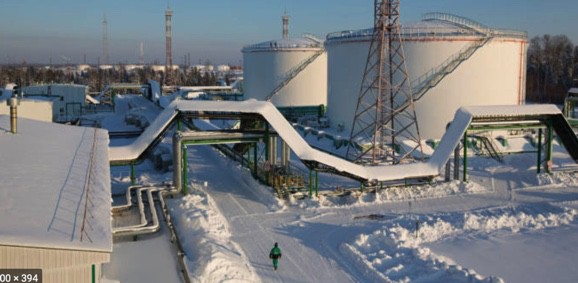

GENOIL SIGNS ADVISORY AGREEMENT WITH JSC TUIMADDA-NEFT AND PROVIDES UPDATE WITH THE VELIKOYE OIL FIELD Tuimadda-Neft has an estimated 1.8 billion barrels of recoverable crude oil equivalent within their five giant oil field license blocks in Yakutia, Russia NEW YORK,...

Jun 12, 2019 | Press Release

Genoil Inc., the publicly traded clean technology engineering company for the energy industry, announced today that Lic. José E. García Torres, Legal Representative of the company Genoil Inc. and Dr. Fernando Castrejón Vacio, Director of Product Technology of the...

Apr 4, 2019 | General, GenOil Articles

https://shipandbunker.com/news/am/911439-genoil-upbeat-on-high-to-low-sulfur-fuel-conversion-technology Genoil Upbeat on High-to-low Sulfur Fuel Conversion Technology Canadian oil technologist Genoil is upbeat over prospects for its hydroconversion technology which...

Apr 3, 2019 | General, GenOil Articles

Interview: CEO David Lifschultz of Genoil Inc. (OTC: GNOLF) Interview: CEO David Lifschultz of Genoil Inc. (OTC: GNOLF) Marcus HeatherlyFebruary 21, 2017 CEO David Lifschultz of Genoil, Inc. (OTC: GNOLF)(TSX.v: GNO) rejoins Stock Day to talk about recent Lloyd’s...

Apr 1, 2019 | General, GenOil Articles

https://www.bunkerspot.com/global/47784-global-lr-provides-independent-verification-for-genoil-s-ghu-process A process demonstration witnessed by Lloyd’s Register showed that Genoil’s hydroconversion upgrader can convert high sulphur heavy fuel oil into IMO...

Mar 31, 2019 | Press Release

Canada’s Genoil says it has enlisted the help of Lloyd’s Register (LR) to add credibility to its oil and bunker desulfurization process. In turn, LR has – along with a considerable caveat – verified that Genoil’s bunker...